By FutureLaw Desk

The government of Bangladesh has unveiled a record BDT 4 trillion (about USD 49.41 billion) national budget targeting an economic growth of 7.4 percent for the 2017-18 fiscal year starting in July. The budget was proposed at the Parliament on June 01, 2017 by Mr. Abul Maal Abdul Muhith MP, the Minister of Finance.

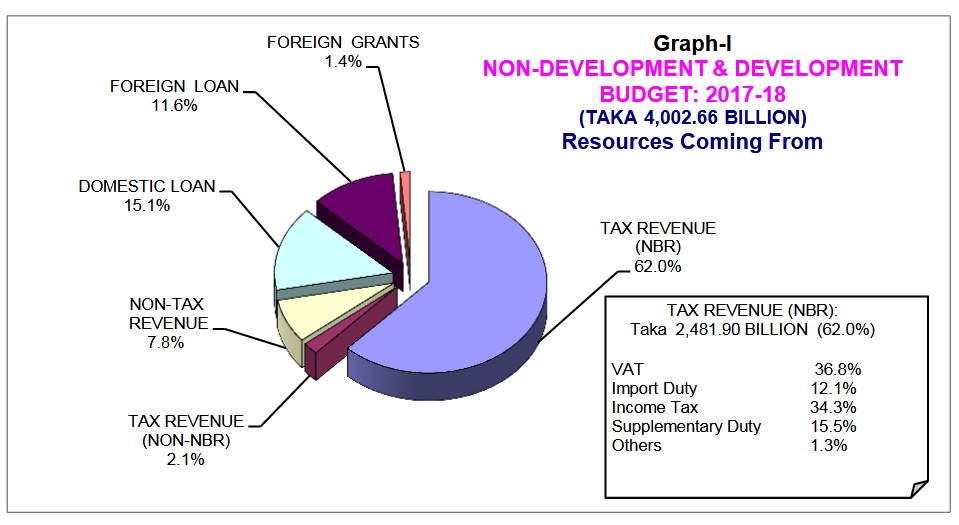

At the outset, the primary stream of the resources for this ambitious budget is coming from the taxes (income tax, VAT and supplementary duty) from the National Board of Revenue. The following chart provides the allocation –

Streams of Resources for FY 2017 – 2018

A comparative analysis of the revenue receipts shall provide a clear picture of the aggressive nature taxation of the new fiscal year.

[gview file=”http://d30fl32nd2baj9.cloudfront.net/media/2017/06/01/broad-details-of-revenue-receipts.pdf/BINARY/Broad+Details+of+Revenue+Receipts.pdf” save=”1″]Some of the core issues on tax policy that affects the people are highlighted below –

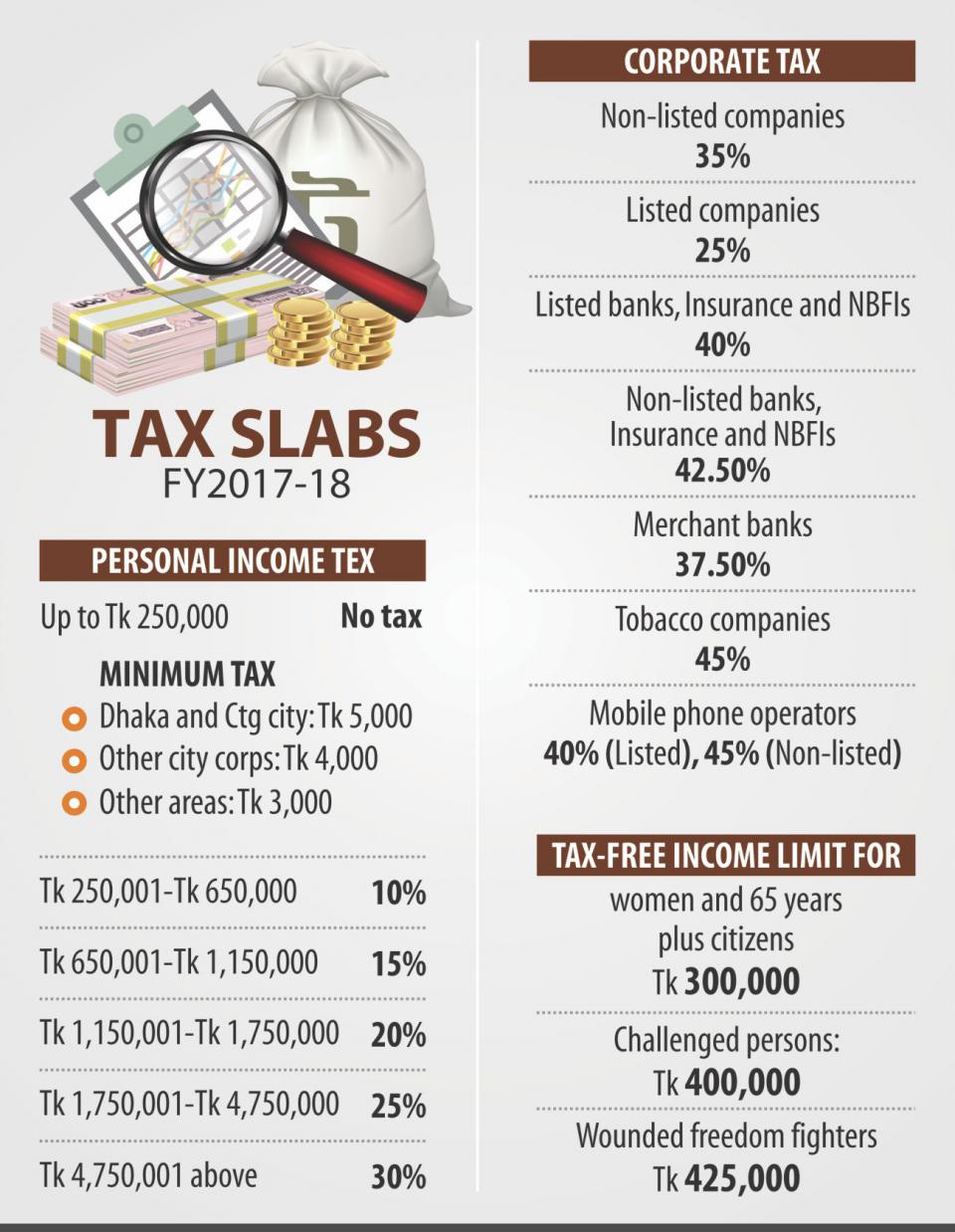

Income tax slabs to remain as is

No major changes has brought into the taxation policy from the previous budget. However, reduction of corporate tax from the current 20 per cent to 15 per cent for the readymade garment export sector has been proposed in Budget 2017-18 presented in Bangladeshi parliament. For readymade garment companies possessing internationally recognised green building certification, the Budget proposes reduction of tax rate to 14 per cent.

Courtesy – The Daily Star

Uniform value added tax (VAT) set at 15%

Bangladesh is finally going to implement a single and uniform VAT rate, ending the prevailing system of multiple VAT rates for different goods and services which was effective from 1991. As per the decision of the Govt., from July 1, 2017 everyone eligible will have to pay 15% VAT on most goods and services. However, the VAT-free turnover ceiling is proposed to be increased at BDT 36 lakh from the previous proposal of BDT 30 lakh. As many as 1,300 products have been brought under the coverage of new supplementary duty. All of these will be reflected on the upcoming VAT and Supplementary Duty Act, which is under serious protest from the business community.

Excise Duty on Bank Savings increased

The finance minister proposed imposing BDT 800 Excise Duty instead of existing BDT 500 in cases where the balance, whether debit or credit limit, is between BDT 1 Lakh and BDT 10 Lakh. The excise duty shall be BDT 2500 instead of BDT 1500, where the balance is between BDT 10 Lakh to BDT 1 Crore. For the balance of BDT 1 Crore to BDT 5 Crore, the excise duty shall be BDT 12,000 instead of BDT 7,500.

“It is very difficult to give a definition of rich men. But I know the people who keep Tk 1 lakh or more into their bank accounts are capable of bearing the expenditure of the excise duty.”

~ Abul Maal Abdul Muhith, Minister of Finance

Furthermore, travel tax (air travel) outside the SAARC region has been doubled than the previous amount. Analysts suggest that all of these measures shall have a direct impact on the habit of transaction of general people, and they will gradually lose interest over the banks.

Conclusion

The proposed budget seems to has failed to take into consideration the growing middle-class of Bangladesh with the aggressive taxation policy. Especially the impact of VAT shall directly affect the people, as it will boost the price hike of consumer products. Eminent economist Debapriya Bhattacharya (distinguished fellow of Center for Policy Dialogue) termed the proposed budget for the FY 2017-18 as “economic illusion” saying that there is no clear indication between income and expenditure in it.