By Ali Mashraf

On July 06, 2016, Leonel Messi and his father, Jorge Messi were both found guilty of tax fraud and handed down prison sentences of 21 month as well as ordered to pay fines worth €1.7 million and €1.4 million respectively. However, neither Messi nor his father were expected to serve their prison terms since under Spanish law, prison terms below two years can be served under probation for first-time offenders.

The case and its subsequent verdict has been the talk of the media ever since. Messi and his father have appealed against the sentence via the Spanish Supreme Court.“The sentence is not correct and we are confident the appeal will show the defense was right”, remarked Messi’s lawyers after the verdict was delivered.

Messi and his father had already paid more than €5 million equal to the alleged unpaid taxes and interests to the Spanish government back in August 2013. Throughout the trial, Messi maintained his innocence saying that his father had always handled his finances and that he was unaware of the proceedings. Additionally, Messi stated that he always went along with the recommendations of his father on the issues of investments and related financial transactions.

His father, Jorge acknowledged his own responsibility but shielded himself by saying that he trusted the family’s consultants in good faith to deal with the finances.

Surprisingly, the prosecutors favored Messi’s portrayal and were not eager to press charges. Rather, they sought a prison sentence of 18 months for Jorge. However, the state lawyer’s office was the only party adamant to request punishment for Messi and his father.

When looked into the finer details of this case, a few glaring loopholes emerge. These need to be analyzed well before reaching the conclusion as to whether Messi and his father had been guilty or not. Firstly, Article 305 of the Spanish Penal Code refers tax fraud as “he who by action or omission defrauds the Public Treasury” of at least €120,000.In Spain, it is a matter of debate as to how the word “defraud” would be interpreted and to what extent it requires the knowledge or intent of a defaulter to prove his guilt.

Messi’s father in 2005 trusted Rodolfo Shinocca with the fiscal optimization of income from image rights of Messi when he debuted as a player for FC Barcelona at the age of 17. Fiscal optimization implies finding the most tax-efficient way possible whilst respecting legal prescriptions. In simple terms, Jorge wanted to pay the least possible amount of taxes in a legal way.

This system, similar to the Double Irish Arrangement can be considered immoral as they allow people and companies with exorbitant income to pay less in taxes compared to the average person who has no access to these complex tools of fiscal savings. However, they are legal instruments.

The complaint could not have gone this far had Messi’s consultants exercised precaution while dealing with the scheme. They obtained his signature in the form of notary to release his image rights which gives this a public validity. They were careless and did it in a way that could interpret their action as scam. This ultimately proved to be the reason behind the tax fraud accusation.

Lionel Messi

Secondly, if we look at the past instances of tax fraud of several players in Spain, we see that none of them were handed out prison sentences. Jose Mourinho, former manager of Real Madrid closed his tax evasion case after paying the full amount, including interests for delay and fine asked by the Spanish Treasury. Spanish goalkeeper Iker Casillas did nothave to pay the fine even as the Treasury considered that he had no intention to defraud them. FootballerXabi Alonso and world renowned tennis player Rafael Nadal settled their cases without having to face any prison term.

The above mentioned people were all found guilty in their respective cases. Yet, Messi seems to be the only one to face a prison sentence along with payment of fine.

Thirdly, Messi has received a harsher sentence than his father when the prosecutors have already identified Jorge as the intellectual mastermind of the scheme. This vastly differs from a similar case recently in Spain. In the Noos case, Infanta Cristina of Spain was adjudged to be innocent for her ignorance despite being an adult and having the necessary qualifications. But Messi, 17 at the time of the signing of the image rights was not an adult and had zero knowledge of the scheme devised by his father, was found guilty. The judge accepted the claims of the State Attorney that Messi was the man to plot this scheme and he turned his father into a collaborator to escape conviction.

Lastly, the State Attorney sought prison sentence against Messi despite the public prosecutors not wanting to press charges against him. The duty of the State Attorney is defending the interests of the Public Treasuryby recovering of the defrauded amount with proper interest rate and the threat of prison term to be used for accelerating the payment of the sum. Yet, they are seeking prison sentence against a man who is currently the leading taxpayer in Spain, with over €100 million paid. This is an absolute discrimination against Leo Messi since this verdict has stark contrasts to the previous ones, where the penalty for such action was only the payment of debt along with fine.

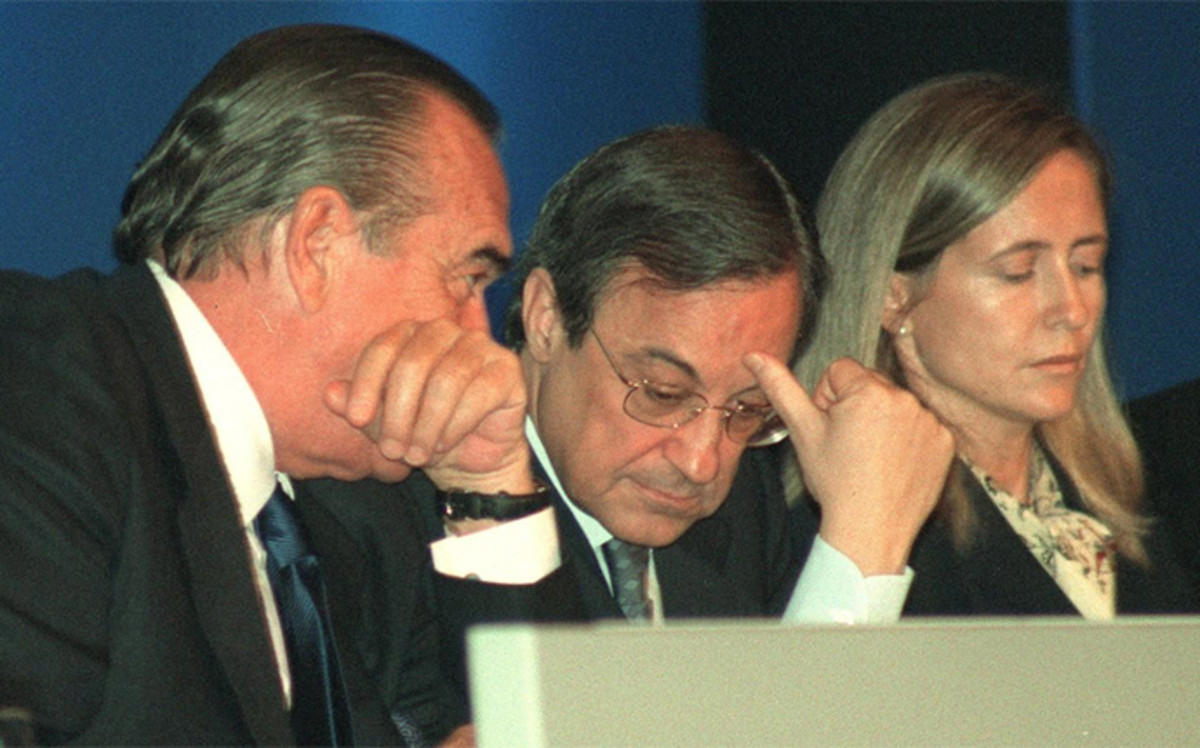

Real Madrid FC president Florentino Perez (middle) and Marta Silva de Lapuerta (right) in a meeting

The fact that the Director of the Juristic Service of State Legal Service that sought this harsher sentence against Messi is Marta Silva de Lapuerta, a renowned Real Madrid supporter and member of Florentino Perez’s (current president of Real Madrid) directive board between 2000 and 2006 raises more eyebrows towards the whole procedure.

Messi and his father have appealed against the verdict. In Barcelona, the campaign started in favor of Messi fell flat as it was interpreted to justify the criminal act of tax evasion. However, FC Barcelona were not seeking preferential treatment for their superstar; rather they were protesting against the harsher verdict laid down by the court. The player and his father have appealed in the Supreme Court and await the verdict. Nonetheless, it can be said that the whole procedure of this trial has been shady and carried out in an inappropriate manner.

Ali Mashraf is a contributor of the Future Law Initiative and Vice President (Marketing) of Network for International Law Students- University of Dhaka Chapter. He is currently pursuing his LLB (Honors) degree from Department of Law, University of Dhaka